2025 NRRA National Conference: Top Takeaways & Strategic Insights for RRGs

Highlights from the premier risk retention group industry conference of the year

Introduction

Held October 6–8 in Chicago, the 2025 NRRA National Conference brought together RRG leaders, regulators, service providers, students, and industry advocates for three days of focused education, networking, and discussion. Now in its 11th year in Chicago, this year’s conference saw a post-COVID attendance record, an influx of new faces, and the highest number of insurance regulators in conference history.

Sessions explored the evolving RRG landscape shaped by emerging technologies, NAIC initiatives, economic pressures, and industry-specific challenges. From panel presentations to breakout discussions, attendees left with strategic relationships, insights, and practical tools to strengthen governance, manage emerging risks, and navigate the year ahead.

NRRA was joined by four students from the Katie School of Insurance and Risk Management at Illinois State University, who were able to learn gain real-world exposure to the RRG industry through NRRA’s Collegiate Research Insurance Shadow Program.

Students from the Katie School of Insurance and Risk Management at Illinois State University learn during the breakout roundtable discussions.

The 2025 Karen Cutts Visionary Achievement Award was given to Heather Ross, Vice President of Regulatory Compliance at Risk Services, LLC, for her 30+ years of diverse experience in the risk retention group insurance arena.

Risk Services, LLC Vice President of Regulatory Compliance, Heather Ross receives the 2025 Karen Cutts Award for her outstanding work in the RRG industry.

2025 Conference Recap

This year’s conference brought together leaders from every corner of the RRG industry. While the topics were wide-ranging, several clear themes emerged.

AI & Cybersecurity: New Opportunities, New Risks

Artificial intelligence and rapidly developing technology offer exciting opportunities for RRGs, but they also introduce new liabilities. This year’s sessions on AI and cybersecurity emphasized the need for proactive oversight, careful vendor management, and a strong understanding of how these tools work.

In The Antithesis of AI, speaker John Ellis (Codethink) warned that software failures are no longer edge cases—they are everyday risks. He urged the industry to move beyond “security theater” and start demanding systems that are truly testable, trustable, and transparent.

US President of Codethink, LTD, John Ellis, presents the first session, “The Antithesis of AI - What Our Tech is Not Supposed to Do.”

That message carried into Avoiding Hidden Bias in AI Claims Handling & Underwriting, where panelists Lydia Floyd (ContractScope), Geoffrey Miller (Custom House Risk Advisors), Neil B. Posner (Much Shelist), and Sara Schroeder (Allied Professionals Insurance Services) illustrated how AI tools can inherit historical bias, violate discrimination laws, or create liability even when used by third-party vendors. Their takeaway: insurers and RRGs must audit algorithms, demand transparency from vendors, and maintain human oversight at every step.

Cybersecurity threats were front and center in The Cyber Risk Playbook, where Angela Elbert (Neil Gerber & Eisenberg), Sara Schroeder, Latosha Ellis (Hunton Andrews Kurth LLP), and Melvin Osswald (Tokio Marine HCC) walked through real cyber breach examples, ransomware trends, and hidden gaps in cyber policies. Panelists stressed that vendor contracts are often a weak link and that coverage limits, indemnity, and vendor insurance should be reviewed as part of every risk management strategy.

In a live demonstration during Forming an RRG Using AI, Anne Marie Towle (Hylant), Robert J. Walling III (Pinnacle Actuarial Resources, Inc.) and Cameron MacArthur (AI Insurance) used ChatGPT to build a hypothetical RRG. Their session exposed both the potential and limitations of generative AI, highlighting that without human feedback, context, and legal oversight, these tools can’t yet replace industry expertise.

These sessions made it clear that while AI and emerging tech offer new efficiencies, RRGs still remain responsible (and liable) for every decision made by their tools, vendors, and systems.

Best Practices for RRG Leadership, Governance, and Strategy

Sessions offered tangible, expert-driven insights to help RRGs (and the professionals who support them) operate stronger, smarter, and with more resilience.

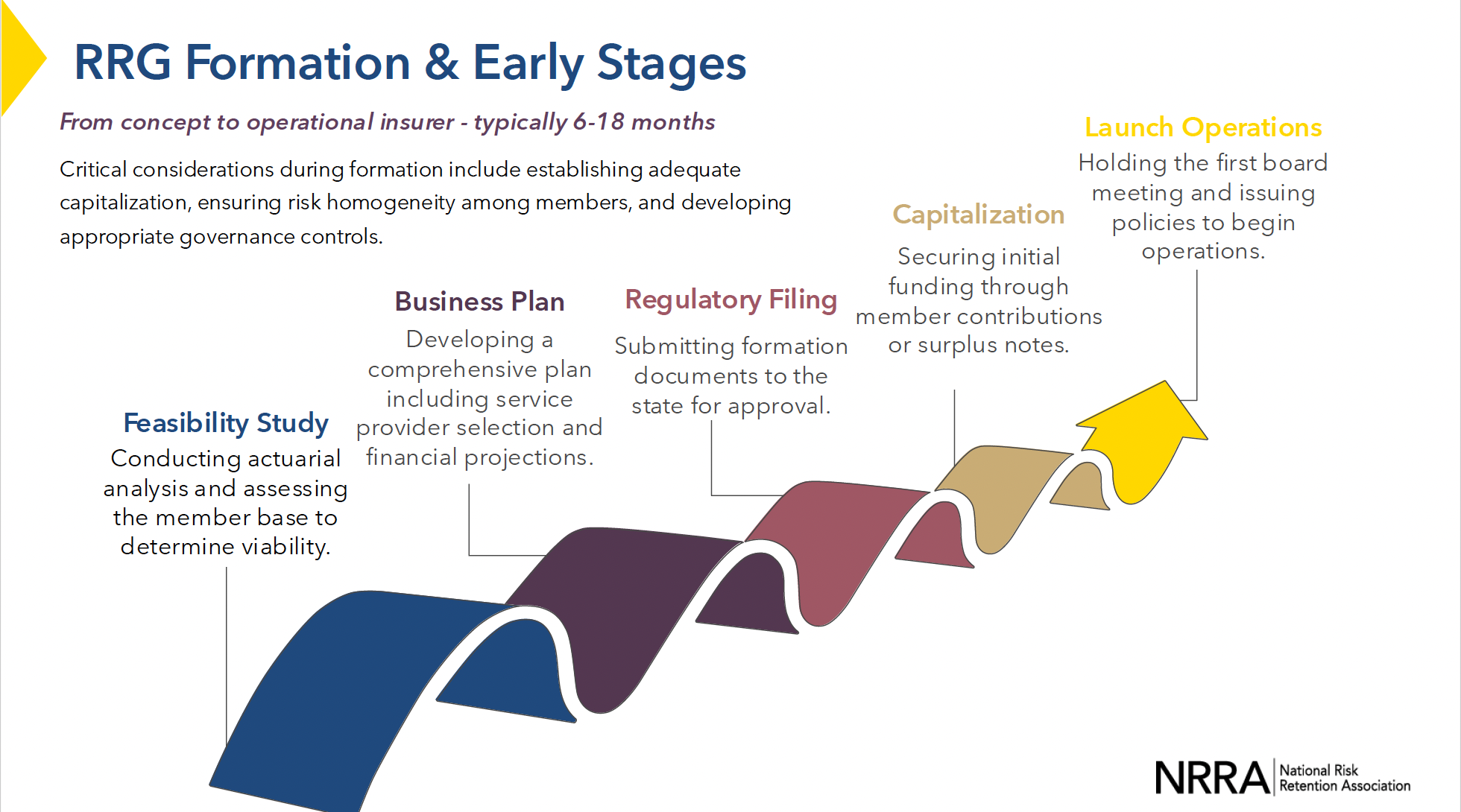

In Navigating the Life Cycle of a Risk Retention Group, Michael C. Meehan (Milliman), Chris Schubert (Pinnacle), Sydney McIndoo (CedarStone), and Michael Coulter (Aon) emphasized that informed decisions in the earliest stages—like drafting bylaws, selecting vendors, and aligning on purpose—can determine whether an RRG thrives or falters down the line. They noted that early planning and open communication with key service providers create the foundation for long-term success.

RRG formation & early stages notes from “Navigating the Life Cycle of a Risk Retention Group: Insights from Actuaries and Managers.”

Reinsurance was the focus in a panel led by Michael Schroeder (Allied Professionals Insurance Services), Ted Davey (Gallagher Re), Kent Larson (Gen Re), and Steve McElhiney (Augment Risk). They outlined how liability-focused reinsurance is tightening through higher rates, more restrictions, and tougher retention demands and encouraged RRG leaders to work proactively with reinsurers to secure tailored coverage that supports both solvency and growth.

In Update on Developments in D&O Claims, panelists Shawn Dewane (Dewane Investment Strategies), Jennifer Hamilton (NAMIC Insurance Company), Erica Sandner (One80 Intermediaries), and Christine Pacheca (One80 Intermediaries) warned that many organizations underestimate their D&O risk. They mentioned common pitfalls including underestimating the impact of social inflation, failing to reevaluate limits, or believing “it won’t happen to us.” Speakers urged RRG boards to invest in quality D&O coverage and adopt sound documentation and governance practices.

Board responsibilities were further explored in Board Members and Officers Governance Training, where Shawn Dewane was joined by Heather McClure (Helio Risk), Jim Neubauer (Recover Insurance Company), Michael Corbett (Pinnacle Financial Partners), and Christina Kindstedt (Advantage Insurance Management). They unpacked what makes a strong, accountable board: avoiding conflicts of interest, engaging in regular strategy reviews, and creating written processes that support transparency and good decision-making.

Finally, in Creating the Perfect BOP and Work Comp Program, Michael Schroeder, Chris Rogers (Guy Carpenter & Company), and Alex Hardy (Beazley Syndicate at Lloyd’s) discussed how RRGs can support their members’ broader insurance needs by working with trusted partners. Though RRGs cannot write property or workers’ comp, panelists shared how a coordinated brokered approach to bundled offerings can provide insureds with convenience, continuity, and better risk alignment.

Taken together, these sessions reminded attendees that RRG success is not just about checking obligatory boxes—it’s about proactive strategy, collaboration, and thoughtful execution at every stage.

Regulatory and Economic Outlook for Risk Retention Groups

Multiple regulation and economics-focused panels highlighted evolving NAIC initiatives and economic pressures that are shaping the short and long-term RRG environment.

In Regulators Panel No. 1, speakers Sandy Bigglestone and Christine Brown (Vermont Department of Financial Regulation), Steve Kinion (Oklahoma Insurance Department), and moderator William P. White (Acuity Strategic Consulting) provided updates on NAIC initiatives impacting RRG oversight. Key developments included the upcoming Risk Retention Group (E) Working Group, set to launch in 2026, focused on aligning RRG best practices, risks, solvency concerns, and facilitating more collaboration in respect to oversight of risk retention groups across domiciliary and non-domiciliary states. The panel emphasized the value of regulator-to-regulator dialogue and the potential of the Working Group to help increase confidence among other states in regulating RRGs.

Regulators Panel No. 2, featuring Dan Petterson (Vermont Department of Financial Regulation) and Tim Herr (Recreation RRG), reinforced the importance of constructive communication with regulators and commissioners, pointing out that NRRA’s recent engagement in RRG education for the NAIC helped soften the NAIC’s perceived attitude towards RRGs. Regulators in the room encouraged RRGs to communicate often with their domiciliary regulators and equip their domiciliary regulators with the information they need to confidently support them during multistate scrutiny.

Shifting to the economic landscape, keynote speaker Scott Colbert (Chief Economist, Commerce Trust) outlined macroeconomic headwinds—from weak job growth to mounting deficits—and urged attendees to prepare for inflationary claims and economic uncertainty. He framed the current moment as a time of fragile confidence, emphasizing that trust in financial systems and data-driven planning will be crucial in the years ahead.

Chief Economist of Commerce Trust, Scott Colbert delivers the 2025 Conference Keynote presentation.

In the Economy & Investments session, Leon Rives (RH CPAs), Carl Terzer (CapVisor Associates), John Saf (Calamos), and Greg Cobb (Sage Advisory Services) translated economic trends into actionable investment strategies for RRGs. Panelists advised caution on stagflation risk, diversification, and optimizing portfolios by life cycle stage—from new to mature RRGs. Their message: adapt investment strategies to outpace claims inflation and ensure long-term claims-paying ability.

Together, these sessions reminded attendees that successful RRGs must stay attuned to changing regulatory landscapes and macroeconomic shifts—and act early to remain resilient.

Challenges Facing Trucking RRGs: Fraud, Compliance & Education Gaps

In Disruptive Challenges Facing Transportation RRGs, panelists Rod Nofziger and Stephanie Hanna (OOIDA), Alex Petrovich (Circle Star Insurance Co.), Matt Holycross (Palmetto Consulting of Columbia), and Brian Menendez (Professional Transportation RRG) outlined how transportation risk retention groups are operating under mounting challenges from regulatory hurdles, fraud, and supply chain RRG biases.

The trending growth of trucking RRG adverse claim development from “Disruptive Challenges Facing Transportation RRGs.”

One of the most pressing concerns was the federally required MCS-90 endorsement. While intended to protect the public, panelists explained that it undermines sound underwriting by obligating RRGs to cover claims they may not have priced for—creating structural risk for groups that are otherwise financially disciplined.

Education gaps within the trucking supply chain were also called out. Many shippers and transportation platforms exclude or restrict RRG participation due to confusion around solvency, AM Best ratings, or group-based liability coverage. Speakers pointed out the need for industry-wide education to prevent discrimination and help trucking RRGs compete on a level playing field.

Panelists also addressed the surge in freight fraud and cargo theft, which has increased over 1,200% since 2021. From identity theft scams to staged accidents, trucking RRGs are facing increasingly complex claims. Early intervention—within the first 24 hours—along with strong vendor contracts, route consistency, and quality coverage counsel were presented as essential risk mitigation strategies.

While trucking RRGs serve a critical role in the trucking industry, they must navigate regulatory friction, outdated assumptions, and criminal threats more than ever before.

Top 9 Takeaways from the 2025 NRRA Conference

1. Education at every level continues to be essential.

Education for RRGs, boards, management, insureds, and regulators remains a key tool for addressing challenges and supporting the RRG industry’s long-term success.

2. Board governance is a risk management strategy.

Sound RRG boards require qualified leaders, clear roles and expectations, good processes, written procedures, and transparency between insureds and service providers. These practices not only support successful fulfillment of fiduciary duties but also help prevent D&O litigation and other risks.

3. Proactivity is one of the most effective (and affordable) risk management strategies.

Early strategic action—such as drafting strong bylaws, reviewing vendor contracts, evaluating policy limits, and intervening in important claims early—can prevent costly mishaps and lawsuits. The extra time spent up front pays off in long-term protection.

4. Trucking RRGs are facing significant, disruptive challenges.

Small business truckers make up most of the industry, yet trucking RRGs face mounting barriers, including the MCS-90 requirement, surging freight fraud, and discrimination from supply chain players that misunderstand how RRGs work. In this current environment, education, advocacy, and claim control are critical.

5. Customized reinsurance needs are emerging.

Reinsurance terms are tightening with higher rates, restrictions on capacity, and increased retention level requirements. RRGs must collaborate with their reinsurers to create customized programs aligned with their risk profiles.

6. RRGs are liable for their technology and vendors.

RRGs are still accountable for decisions made by the tools and vendors they use. Whether it's a third-party software, cybersecurity vendor, or HR contractor, the legal and ethical responsibility ultimately falls on the RRG. Contract reviews and vendor due diligence are essential.

7. The RRG sector continues to grow.

In 2024, RRGs saw a 8.9% growth in direct written premium and $8.2B in net outstanding reserves. Despite industry growth, considerations during formation including establishing adequate capitalization, ensuring risk homogeneity among members, and developing appropriate governance controls remain critical to an RRG’s long-term success.

8. Regulators and the RRG industry are finding more ways to collaborate.

With the formation of a new NAIC Risk Retention Group (E) Working Group and continued participation in NRRA-hosted RRG educational sessions, regulators are working more closely with industry experts. The hope is that this collaboration will continue to help streamline oversight and improve consistency in the regulation of RRGs across states.

9. As good as AI is getting, it still requires human oversight.

From bias in claims systems, to errors in crafting official RRG documentation, to data breaches, AI still poses a risk when left unchecked. Leveraging AI for increased productivity while still leaning on human knowledge for strategic decisions and review is a smarter and safer way to use AI.

Conclusion

The NRRA 2025 conference covered a large scope of industries and topics to help RRGs in every step of the business lifecycle and move forward with more clarity and confidence.

NRRA extends our sincere thanks to every speaker, sponsor, and attendee who made this year’s event a success. We look forward to continuing the momentum at the 2026 RRG Leaders Summit for RRG Executives in Beverly Hills on March 17, 2026.

NRRA’s 2025 Sponsors

To learn more about NRRA’s upcoming events, visit https://www.riskretention.org.