NRRA 2024 Recap: Artificial Intelligence Insurance Conference Provides Industry Education and Guidance for the Risk Retention Group Community

December 4, 2024

In today’s world of partisan politics, misinformation, and lack of trust and integrity, it is not surprising that Artificial Intelligence (AI) has become a lightning rod for all of the above temptations. Tech companies and service providers all provocatively exhort that there will be big winners and big losers. By now, all industries agree that AI is here to stay, will continue to shake things up, and is not something that companies can afford to ignore.

Are we facing, however, some existential threat to our intellectual integrity? What are the regulatory challenges and will AI push regulation standards to change? How do we address misinformation around our unique industry spread by AI or respond to bad actors already using AI against us? How should we be leveraging AI tools and what do they cost?

How exactly does AI come into play for smaller group “captive” (i.e., self-insured) companies like risk retention groups (RRGs) and risk purchasing groups (RPGs), who often have minimal staff, limited resources, and do not need “big data” to underwrite insurance for their members’ policies?

The National Risk Retention Association (NRRA) sought to address these questions about the larger developing AI landscape related to risk retention groups at its annual conference in Chicago. The event, titled “The AI Revolution in Insurance and RRGs,” delivered content designed specifically for risk retention groups, risk purchasing groups, and the companies that do business with them to 1) Demystify AI and educate on AI basics 2) Address current and expected AI-related industry challenges and 3) Provide ideas and action steps for the risk retention group community to leverage AI appropriately and sustainability as the AI landscape continues to evolve.

The result was a 2.5 day culmination of conversations, relationship building, and AI-centered learning through panels that built on one another among a group of industry experts, RRG business owners, captive managers, reinsurers, captive regulators, other service providers, and a small group of insurance school university students from Illinois State University who provided the students’ input.

Below highlights insights from panel moderators and speakers on some of the main concepts of AI that were applied across topics.

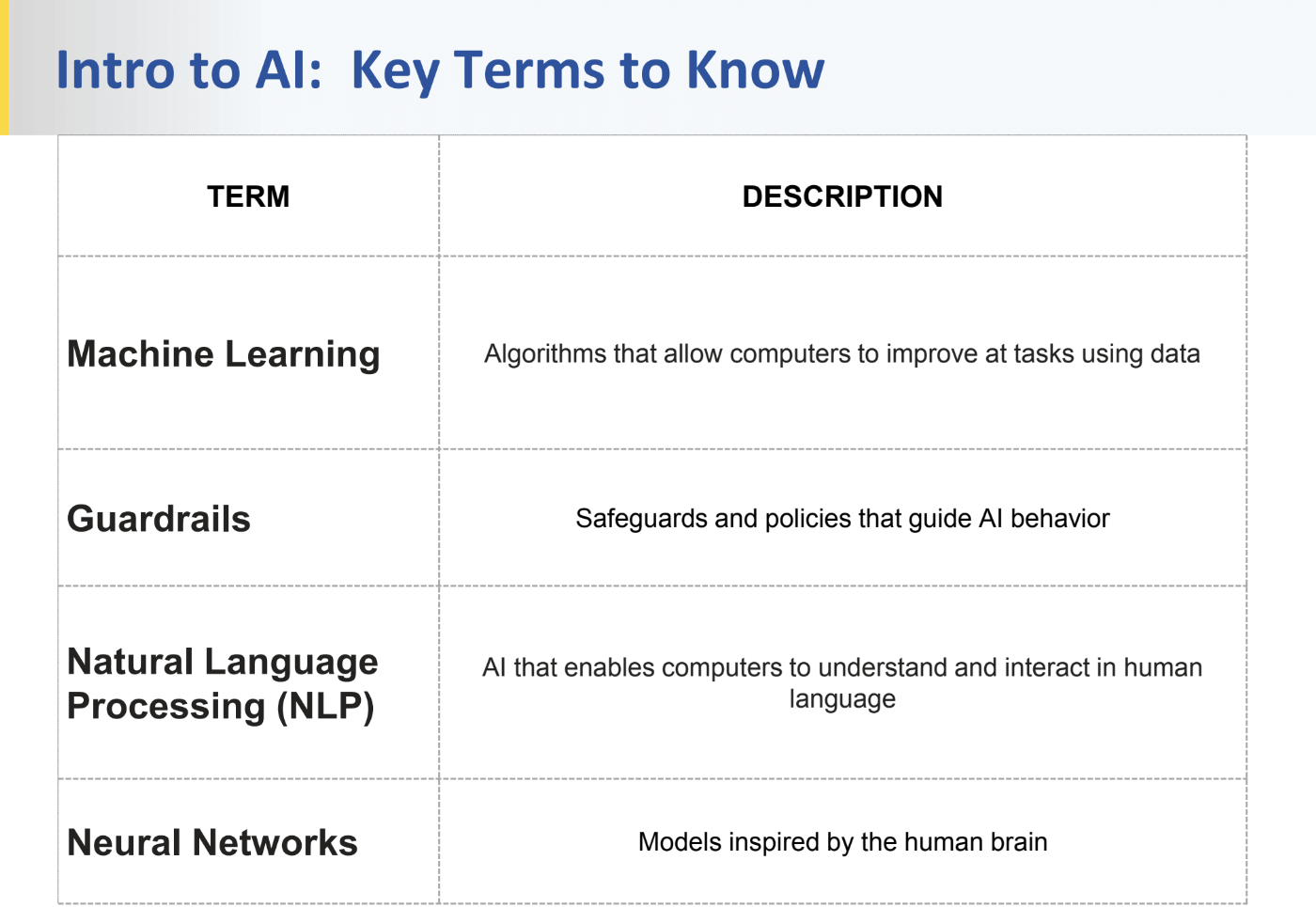

The Basics From the Ground Up

Because attention grabbing headlines around AI sometimes promote more ignorance than education, it was important to NRRA to cover some AI basics. The “Intro to AI” panel kicked off the event, providing foundational content for attendees to get the most out of this AI-centric conference. In addition to providing a background on AI and basic definitions of relevant terms, the panel delivered a message of both opportunity and caution to the industry thought leaders in attendance.

“This session served as a springboard for later presentations which took a deeper dive into the material and allowed for the panelists and audience members to engage in interactive, productive discussion,” noted Michael Meehan (Principal, Milliman, Inc. and panel moderator.)

“Intro to AI – What It is and Why You Should be Ready for It”

“Intro to AI – What It is and Why You Should be Ready for It”

“Intro to AI – What It is and Why You Should be Ready for It”

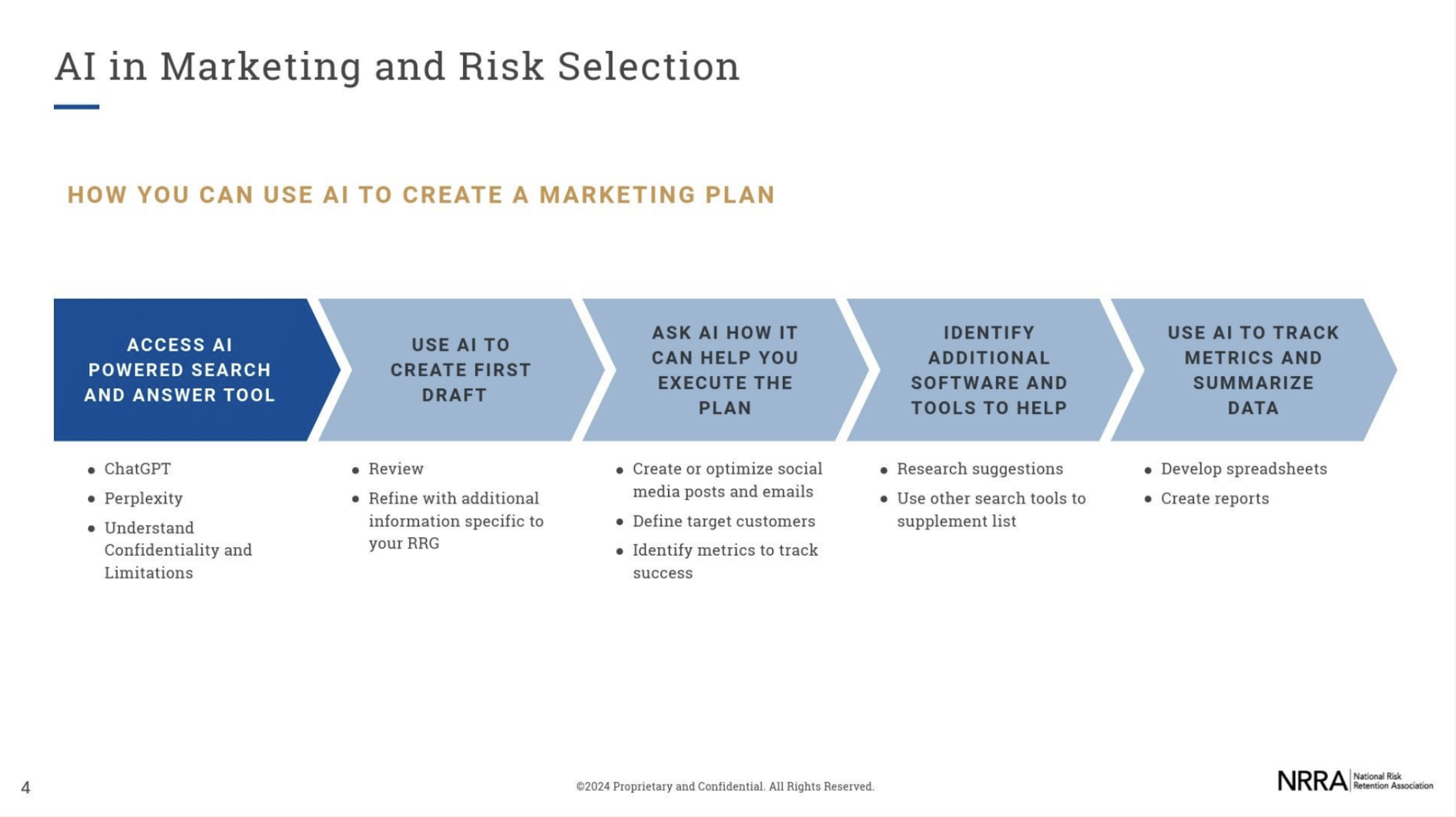

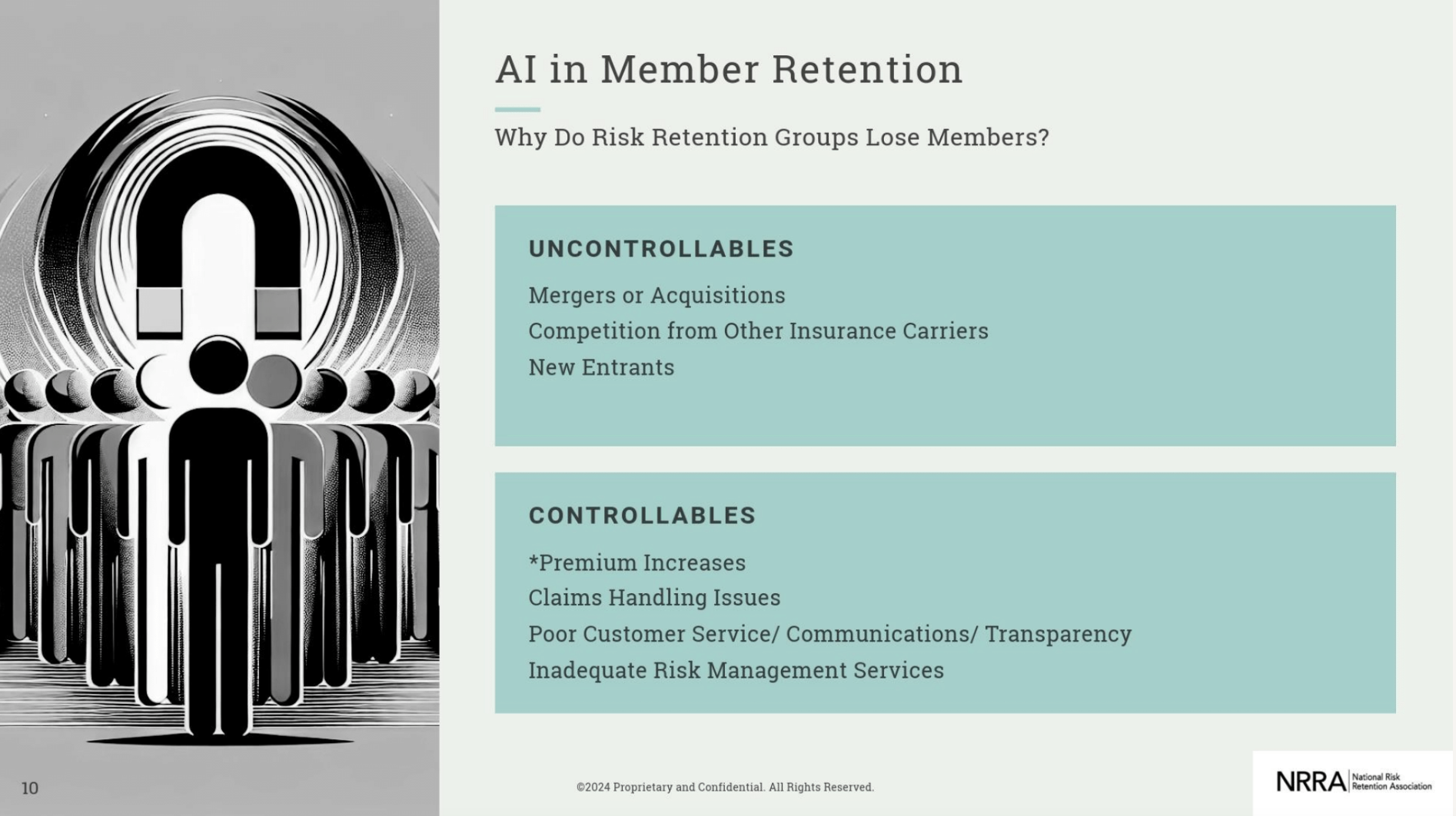

Real World Examples and Actionable Recommendations

Attendees got an inside, behind the scenes look at how companies across the industry are currently utilizing AI to streamline processes and improve their bottom lines. “Our panel (AI and RRGs - How RRGs Utilize AI Now and In the Future) provided concrete examples of how an RRG can begin implementing AI tools throughout all aspects of its operations to assist in risk selection, underwriting, claims handling and member retention,” said Colin Donovan, Conference Co-chairman. “It served as a nice warmup to the fantastic AI-focused panels that followed over the next two days.”

As fellow panelist, Rob Walling (Pinnacle actuarial) added, “we indeed actually used AI to assist us in putting together the materials for this conference.” Some examples follow and are demonstrated throughout this article.

“AI and RRGs – How RRGs Utilize AI Now and In the Future”

“AI and RRGs – How RRGs Utilize AI Now and In the Future”

“AI and RRGs – How RRGs Utilize AI Now and In the Future”

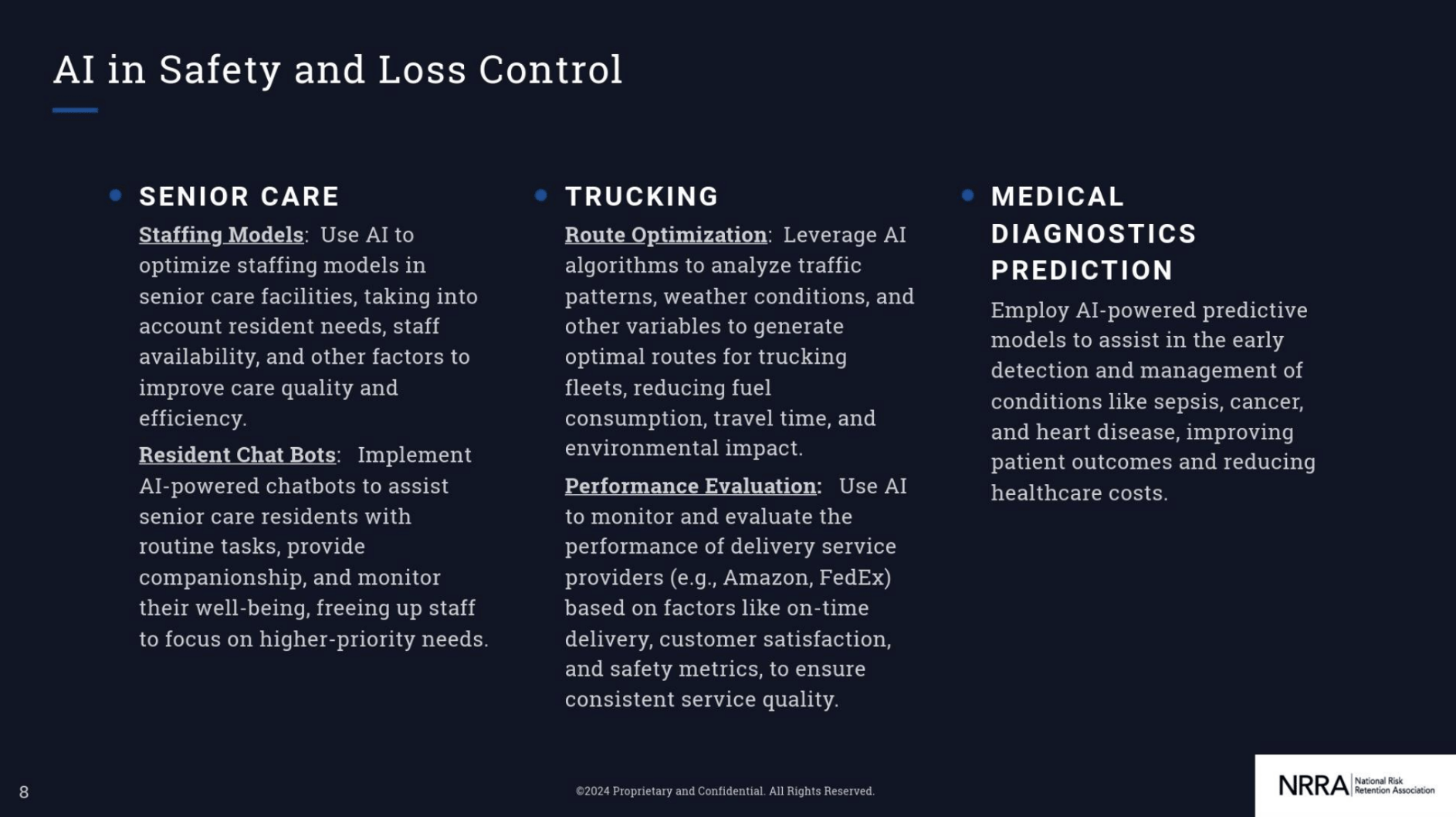

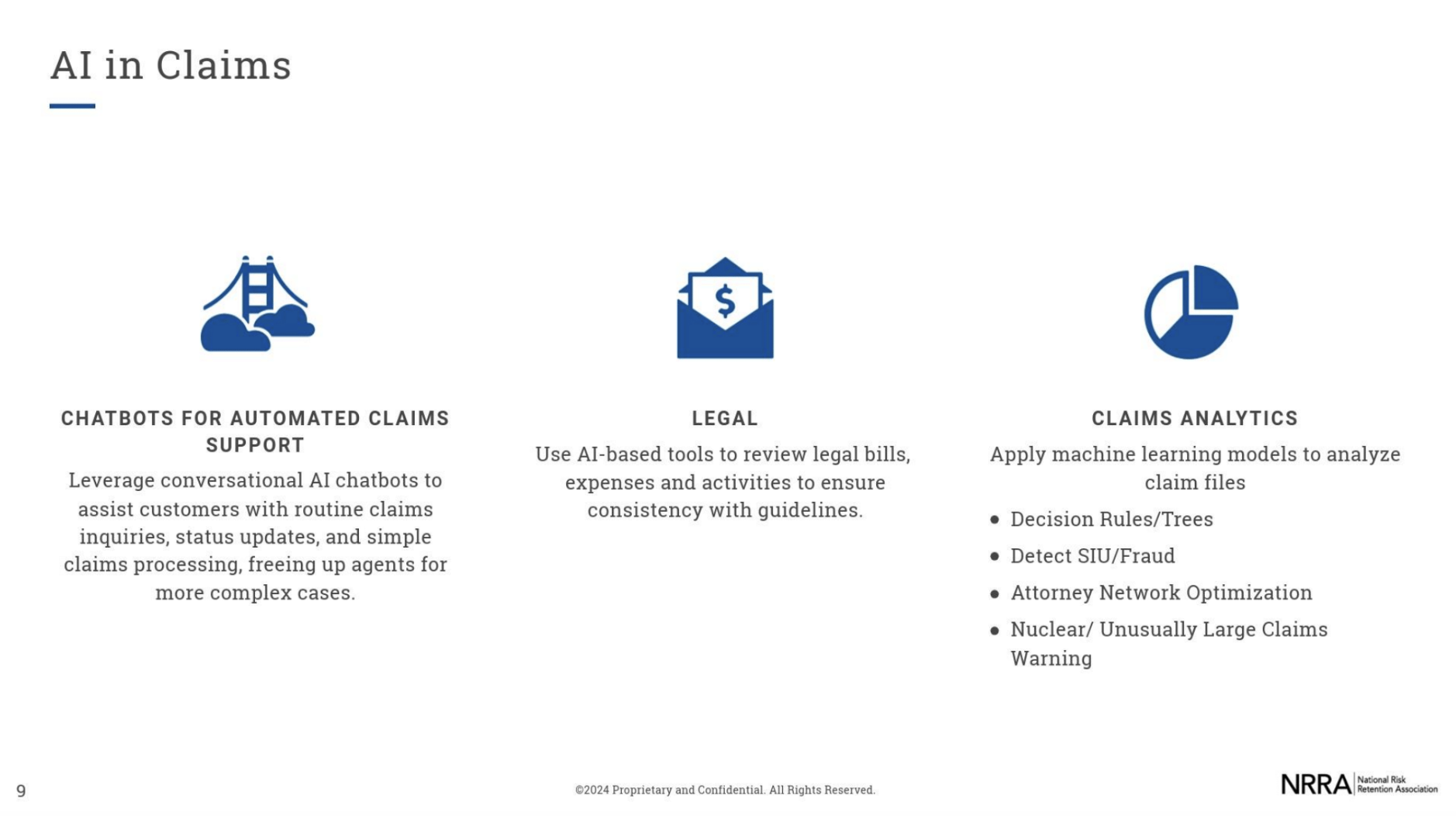

Opportunities in Claims and Underwriting

Tim Parker of Clearbrief, Jean Verrier of Hylant, and Julie Bordo of PCH Mutual’s session on “AI and Operations – The Benefits and Risk of Utilizing AI in Underwriting and Claims Management” generated significant audience engagement. “Our worries about redundancy dissolved as we tackled solutions for our RRG colleagues to build efficiency in our operations, reduce costs and engage our staff in more meaningful work. NRRA did a good job of balancing a single, loaded subject like A.I. with useful information that can be scaled throughout our industry,” said Julie M. Bordo, President & CEO PCH Mutual RRG.

“AI and Operations – The Benefits and Risk of Utilizing AI in Underwriting and Claims Management”

“AI and Operations – The Benefits and Risk of Utilizing AI in Underwriting and Claims Management”

“AI and RRGs – How RRGs Utilize AI Now and In the Future”

“AI and RRGs – How RRGs Utilize AI Now and In the Future”

Ever-Popular Regulators Panels X2

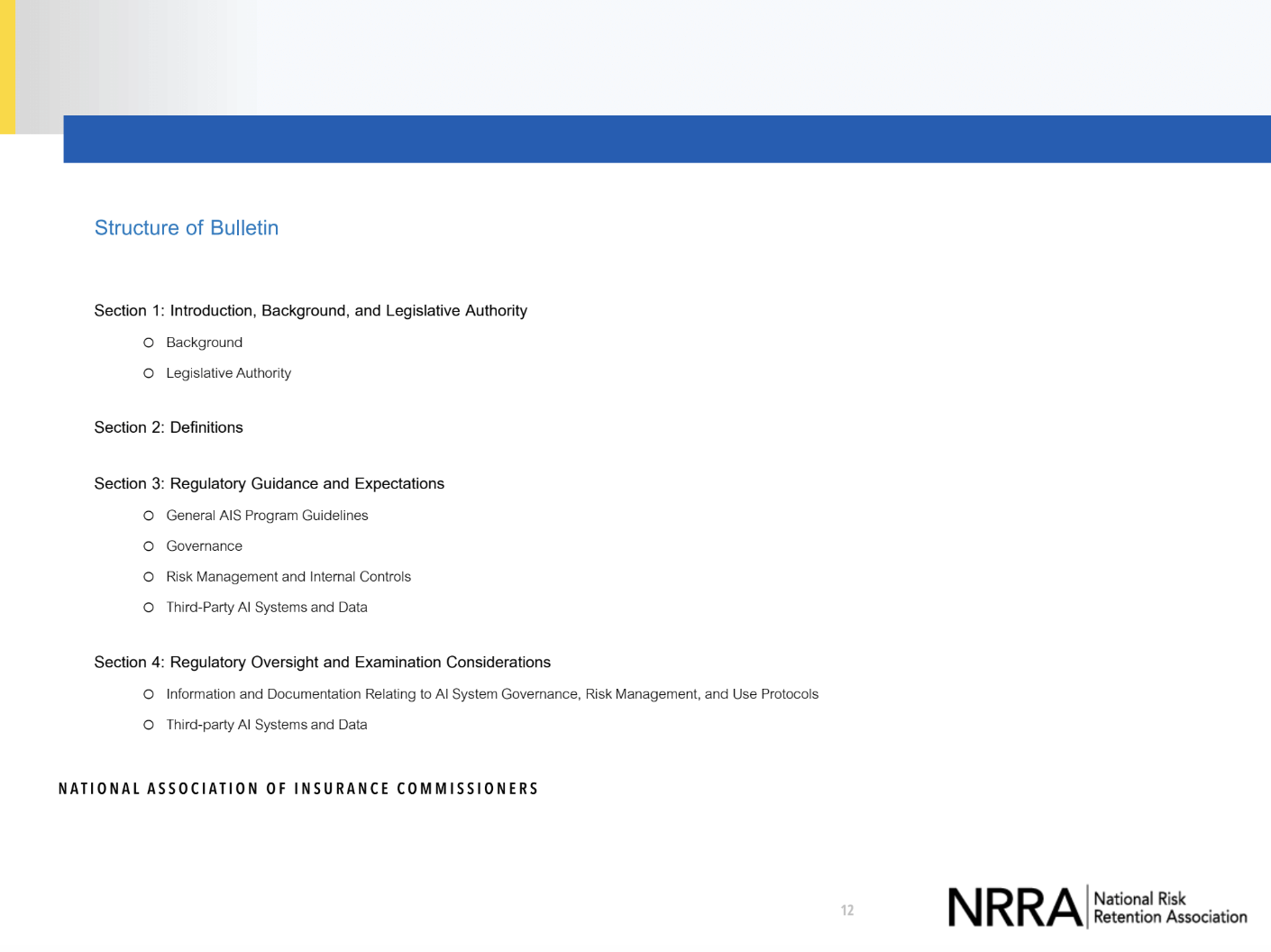

The regulators panel is a long-standing, perennial favorite at the NRRA conference. This year, for the first time, the association had two panel discussions dedicated to regulator issues – one on generic updates and one AI-Thematic – with regulators represented from Vermont, Montana, Tennessee, and Oklahoma. In the latter, attendees learned how the National Association of Insurance Commissioners (NAIC) perceives the potential effects of Artificial Intelligence, followed by a new model of guidelines being promoted by the NAIC.

Analysis provided by Steve Kinion, Captive Insurance Director for Oklahoma, promoted some positive audience responses. “AI may facilitate the development of innovative products, improve consumer interface and service, simplify and automate processes, and promote efficiency and accuracy. However, AI, including AI Systems, can present unique risks to consumers, including the potential for inaccuracy, unfair discrimination, data vulnerability, and lack of transparency and explainability. Insurers should take actions to minimize these risks,…” he stated.

NRRA plans to host virtual “RRG Regulator Educational Sessions” tailored for NAIC, domiciliary, and all regulators in the future. “A collaborative relationship between an RRG and its domicile is essential for operational success and minimizing insolvency risks,” said panel moderator Bill White, Managing Principal, Acuity Strategic Consulting. “The NRRA can play a significant role in encouraging cooperation between RRGs and regulators to uphold the LRRA provisions.”

(Query, what efforts are the NAIC undertaking to ensure that regulators, also, are taking steps to minimize these risks?)

“Regulators Panel – NAIC and RRGs: What’s Next?”

“Regulators Panel – NAIC and RRGs: What’s Next?”

“Regulators Panel – NAIC and RRGs: What’s Next?”

D&O Bootcamp – Best Practices for Directors and Officers

Shawn Dewane (Principal of Dewane Investments, NRRA Board and Sponsor) moderated a D&O Bootcamp session highlighting best practices for directors and officers. According to Erica Sandner, Director UW, Brokers’ Risk, Div of One80 Intermediaries (sponsor), joined by Jennifer Hamilton, President & CEO NAMIC Ins. Co. (sponsor), and Emily Garrison, Honigman, “Our panel provided an overview of board member duties, best practices for corporate governance, corporate indemnification, and transfer of risk through insurance. The panel discussed the unique risk that boards face as they adapt to and provide effective AI oversight, and shared ideas for board policy. The Panel also presented examples of board management, employment practices, errors and omissions, and fiduciary liability claims that RRGs and their Boards face.”

In response to the high interest in this topic, NRRA plans to launch an extensive Directors and Officers training series

Reinsurance – London and Domestic

The conference Reinsurance Panel, moderated by Ted Davey, Gallagher Re (sponsor) reported how properly operated RRGs normally outperform the market. The discussion also explored the current reinsurance market for property and casualty, current issues facing RRGs in these markets, and how AI can be used to enhance this process.

AI, Cyber Risk Management, and the Legal Environment

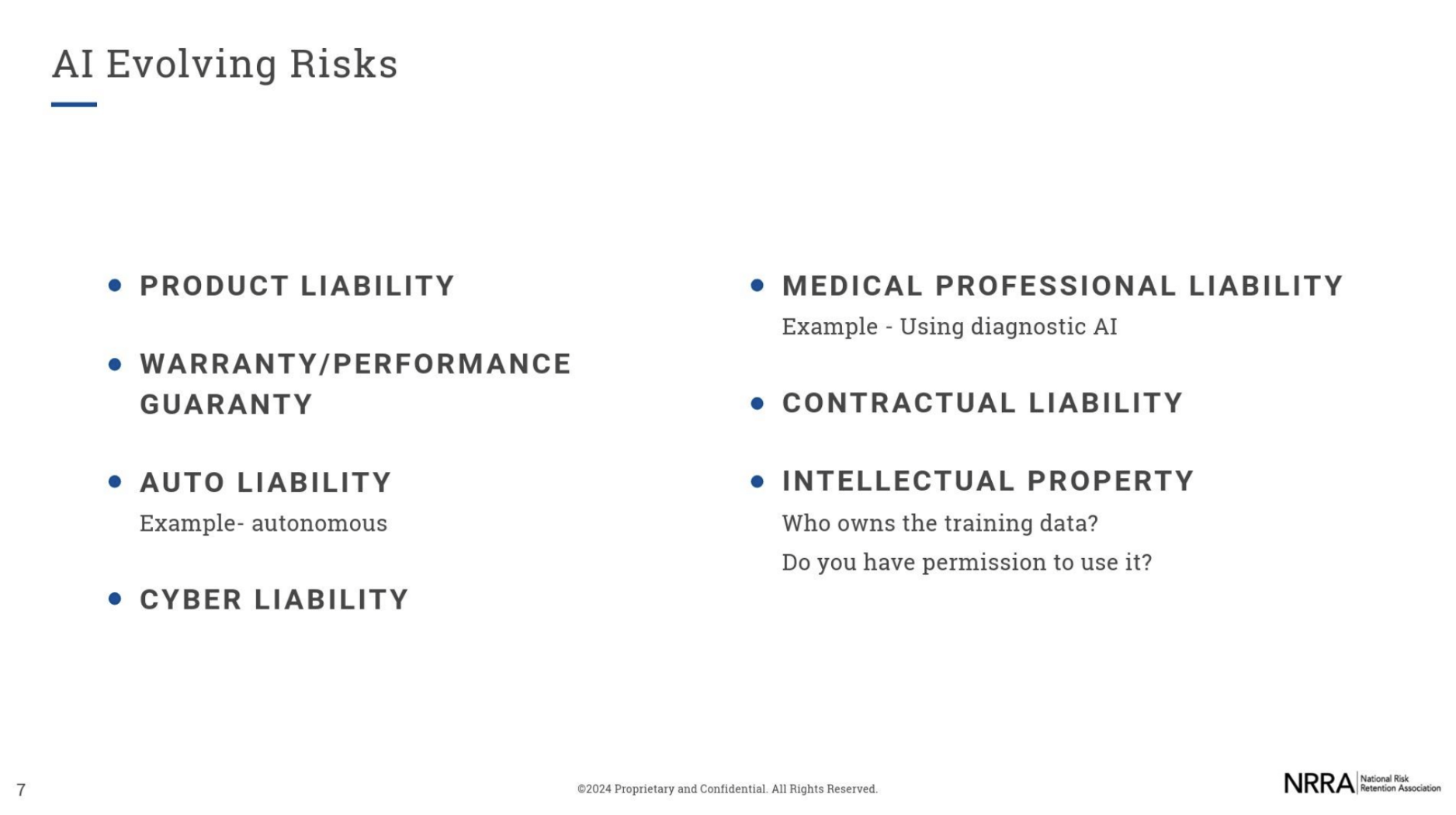

Two areas with the potential to be impacted by AI’s changing landscape significantly are cyber and legal.

“While the conference focused on how AI is changing the industry, our panel addressed confidentiality and bias risks associated with AI tools and the need for robust cybersecurity and cyber risk insurance, most notably multifactor authentication and the value of the response services included with a good cyber insurance policy,” said Geoffrey Miller, Executive Risk Management Consultant & Attorney, Custom House Risk Advisors.

Sara Schroeder, Assoc. General Counsel for Allied Professionals Ins. Co., RRG (Sponsor) noted that she and her panel addressed the current legal environment by focusing on risk management for RRGs related to emerging regulatory issues related to AI and the risks of generative AI, including legal risks, E&O risks, and confidentiality concerns.

“Cyber Risk Management”

“AI and RRGs – How RRGs Utilize AI Now and In the Future”

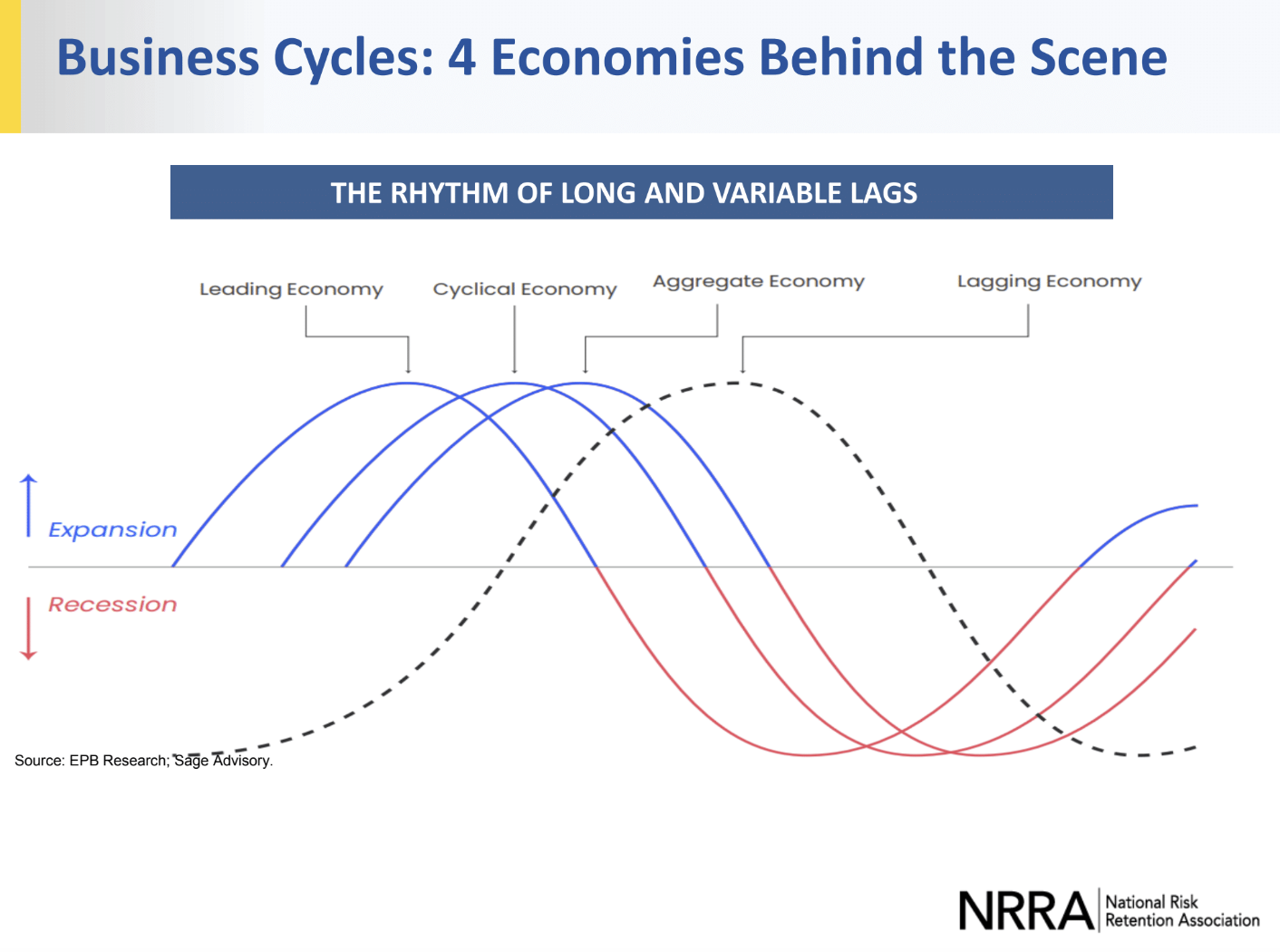

Investments Update with an AI Touch

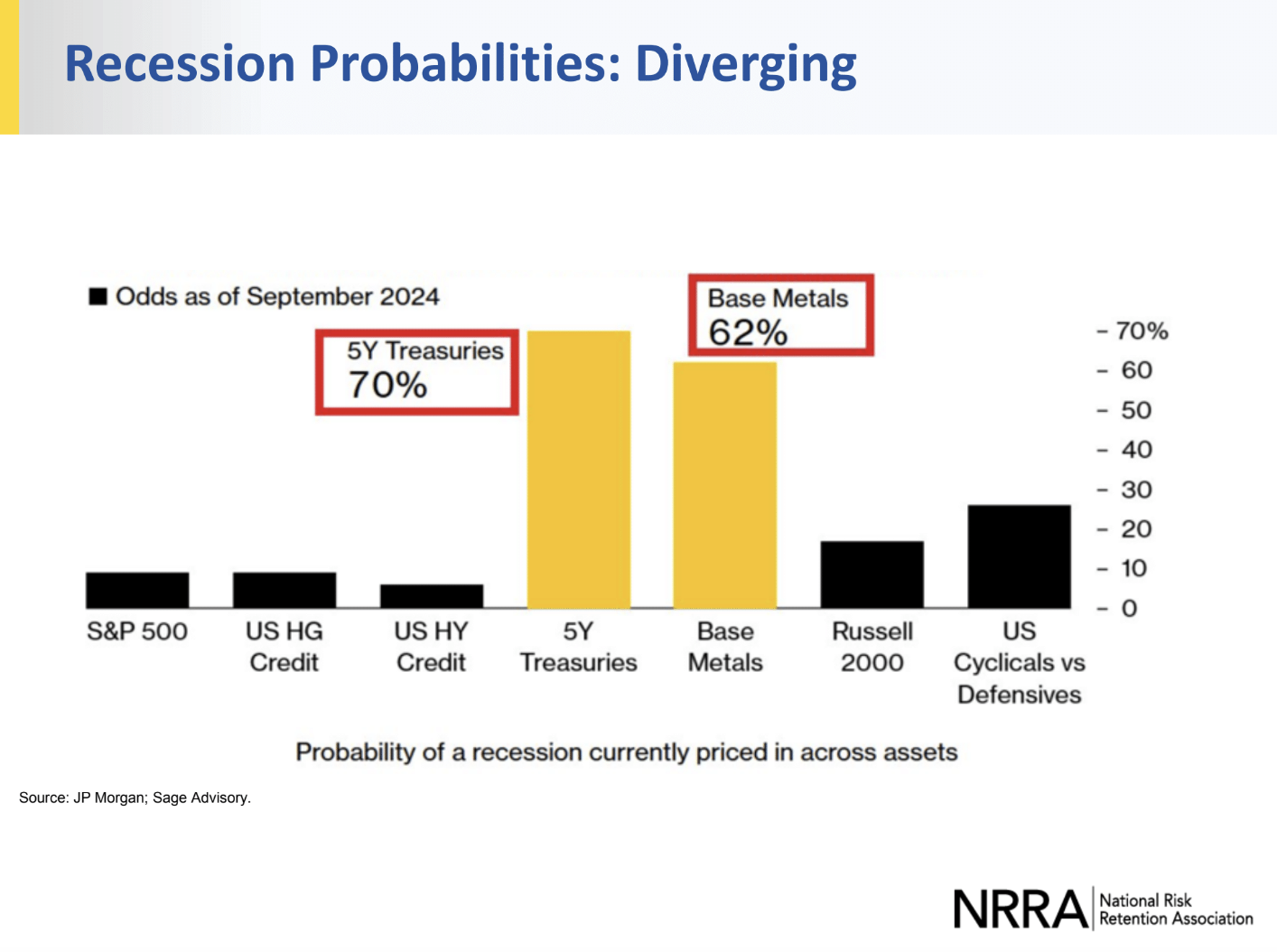

Led by Carl Terzer (Capvisor Associates, LLP; Sponsor) and his co-panelists, John Saf and Greg Cobb, the “Economists and Investments” panel performed a test demonstration sending technical inquiries to four different chatbots with the same questions. After receiving four different responses from each chatbot, the group resorted back to their tried-and-true normal market analyses and methodologies, summarizing that the likelihood of recession in the US has dropped, the probability of a soft landing is still threatened but by the macro global sociopolitical conditions, and asset class and portfolio diversification will provide better investment results. Their point: AI is and always has been and should continue to be simply a tool.

“Economy & Investments”

“Economy & Investments”

“Economy & Investments”

Valuable Roundtables Discussions

NRRA again hosted seven (7) breakout roundtable discussions on specific industry topics including London Reinsurance, Domestic Reinsurance, Trucking, Healthcare/Long Term Care, NAIC Regulators Updates, Captive Manager Caucus, and Adding Complementary Lines & Value-Added Services to Your RRG Offerings. Attendees shared that these roundtables proved insightful and valuable, providing the opportunity for niche conversations, knowledge sharing, and to meet and make connections with others in their specific areas.

AI with People or AI Versus People

The conference concluded with an uplifting, highly educational, and pragmatic presentation by Panelists William McKenzie, Trial Attorney, McKenzie PLLC and Kyser Thompson, Founder and CEO, The Known Collective. Their messages were multiple, that AI cannot replace the human’s role, and departed amongst enthusiastic applause with the following caveats:

“AI With People or AI Versus People? – The HR Impact of AI”

“AI With People or AI Versus People? – The HR Impact of AI”

“AI With People or AI Versus People? – The HR Impact of AI”

Summary

An earlier quote by NRRA’s Keynote speaker, Dan Sullivan, from his 2015 book, Radical Change – The Death of the American Dream (will this be “Cornucopia versus Armageddon?”) put the dialogue in perspective. Are we going down a path where AI will eliminate countless jobs that cannot be replaced by older workers lacking the technical skills, to be contrasted with the younger generation who regularly use AI to do their homework in school, prompting universities to develop programs designed to catch students using AI doing what many of us not too many decades ago used to refer to as cheating?

While some voiced hesitations and fears about the evolution of AI, the various panels complimented one another with a unified message that came across as hopeful about the innovations and possibilities ahead. To many who attended, the foundational knowledge learned at the conference gave them the confidence and foundation they needed to stop ignoring or resisting AI and to continue exploring and learning how utilizing and addressing AI might look for them moving forward.

For those who worry they are too late to the game concerning AI, you’re not. Start by learning about AI, assessing your company’s weaknesses, and building out a vision and guidelines for AI in your organization. Looking forward, it is our prediction that it will not be long until we begin to see AI strategies move beyond companies to begin to help the common person and everyday consumer improve their lives, live happier, healthier, wealthier, and safer. We at NRRA look forward to continuing the AI discussion.

Acknowledgement of Other Contributors to this Article

“We owe a special statement of appreciation particularly here to Colin Donovan (President and CEO of Stico Mutual Ins. Co. RRG)” notes Tina Truax McCuin (TD Bank’s Captive Investments Mgr, Conference Co-chair, and recently elected as NRRA’s new Board Chair.) “Colin, as usual, very modestly shies away from the credit due to him for taking the laboring oar as our Conference co-chair this year and talent search. Colin’s creativity and dedication to this complex project would not have been possible without his diligent hard work and persistence in ensuring that all of our panel groups stayed in their lanes in dropping the altitude of this endeavor down from today’s typical 20,000-foot view to our attendees’ 500-foot view.”

Editorial team contributors:

Rob Walling, Principal, Pinnacle Actuarial – deep dive into his development of practical usages of AI for RRGs

Joe Petrelli, President Demotech, service on two panels, research, sponsorship and support of NRRA in publishing this article

Dan Sullivan, Author, keynoter, panelist, realist and recovering lawyer

Lt. Col. John Tice, active U.S. Air Force, Distinguished Flying Cross Recipient, who brought life into our Veteran’s Day Opening session, honoring those who serve all of us

Lauren Herr, NRRA’s Director of Communications, Digital Marketing and social Media expert

Tim Herr, NRRA’s Website Chairman, Risk Management Officer, Recreation RRG

Mireya Parrales, NRRA Exec Assistant

Conference Sessions and Speakers Mentioned

Intro to AI – What It is and Why You Should be Ready for It

Michael C. Meehan, Principal, Milliman, Inc.

Joseph L. Petrelli, President, Demotech, Inc.

Tim Herr, Risk Management Officer, Recreation Risk Retention Group, Inc.

Tim Sedivy, Founding Account Executive, AI Insurance

AI and RRGs – How RRGs Utilize AI Now and In the Future

Colin Donovan, President, STICO Mutual Insurance Company, a RRG

Lydia Floyd, Founder, ContractScope, Inc.

Leon L. Rives, II, Chief Visionary Officer, RH CPAs, PLLC

Robert J. Walling III, Principal & Consulting Actuary Pinnacle Actuarial Resources, Inc

AI and Operations – The Benefits and Risk of Utilizing AI in Underwriting and Claims Handling

Julie M. Bordo, CEO/President, PCH Mutual Insurance Company, Inc. a RRG

Timothy Parker, Account Executive, Clearbrief

Jean Verrier, Account Executive, Hylant Global Captive Solutions

AI and the Legal Environment – Is AI Increasing the Legal Exposure of Your RRG or Your Members?

Sara Schroeder, Associate General Counsel, Allied Professionals Insurance Services

Joseph T. Holahan, Partner, Baker & Hostetler LLP

Daniel Sullivan, Author

Neil B. Posner, Principal, Much Shelist PC

Cyber Risk Management

Sara Schroeder, Associate General Counsel, Allied Professionals Insurance Services

Geoffrey Miller, Executive Risk Management Consultant & Attorney, Custom House Risk Advisors

Nicholas Pottebaum, Vice President of Reinsurance & Programs, Tokio Marine HCC – Cyber & Professional Lines Group

Imani A. Barnes, Associate Director, Cyber Risk Practice, Risk Strategies

Regulators’ Perspective on AI

Joseph L. Petrelli, President, Demotech, Inc.

Steve Kinion, Captive Insurance Director, Oklahoma Insurance Department

Dan Petterson, Director of Captive Examinations, State of Vermont Department of Financial Regulation – Captive Division

Regulators Panel

Bill White, Managing Principal, Acuity Strategic Consulting

Christine Brown, Director of Captive Insurance of Vermont Department of Finance Regulation

Mark Wiedeman, Director, Tennessee Captive Insurance Department

Kari Leonard, Chief Examiner and Captive Ins. Coordinator, Montana Commissioner of Securities and Insurance Tennessee Department of Commerce & Industry

Reinsurance, Foreign and Domestic Updates

Ted Davey, Account Executive, Program Solutions – Reinsurance, Gallagher Re

Kent Larson, Gen Re

Michael Schroeder, Chairman, Allied Professionals Insurance Company, RRG

Jim Jinhong, Program Solutions, Gallagher Re

Introduction to Directors and Officers Training

Shawn Dewane, Investment Management Consultant, Dewane Investment Strategies

Jennifer Hamilton, President & CEO, NAMIC Insurance Company, Inc.

Erica Sandner, Underwriting Director, Brokers & Risk, a division of One80 Intermediaries

Emily E. Garrison, Partner, Honigman LLP

Economy & Investments

Carl Terzer, Principal & Chief Investment Strategist, CapVisor Associates, LLC

John Saf, Portfolio Manager, Calamos Investments

Greg Cobb, Director of Insurance Solutions, Sage Advisory Services

AI With People or AI Versus People? – The HR Impact of AI

William McKenzie, Trial Attorney, McKenzie PLLC

Kyser Thompson, Founder and CEO, The Known Collective

About NRRA

The National Risk Retention Association (NRRA) is a nonprofit organization and community for education, resources, and business relating to Risk Retention Groups (RRGs) and Risk Purchasing Groups (RPGs). NRRA is led by the country’s most knowledgeable individuals in risk retention groups and advocates for the risk retention group industry as well as provides support for RRGs, RPGs and the companies that do business with them. Some of NRRA’s upcoming initiatives include Directors and Officers Training, virtual RRG Regulator Educational Sessions (tailored for NAIC, domiciliary, and all regulators), and NRRA’s annual RRG Leaders Summit. Visit our website or schedule a one-on-one meeting with NRRA’s Executive Director to learn more.